Financial Wellness Resources

Invest in yourself with financial education. We make it easy. How do you feel about your financial health? No matter your answer, Telcoe offers solutions to help. Membership is available to you. We look forward to meeting you in person, over the phone, or online.

Choose Your Path

Strategies to help you get from here to there.

✔

PLAN

Resources to help you plan for a comfortable retirement, grow your nest egg, and more.

✔

SAVE

Schedule a free financial consultation, set savings goals, and select a deposit account.

✔

SPEND

Engage in convenient and easy-to-use financial tools that help you manage your everyday spending.

✔

BORROW

Explore products, resources, and strategies to obtain the lowest interest rates to stay on budget. Borrow Better >

Financial Wellness Tools

No matter where you are on your financial wellness journey, Telcoe Federal Credit Union is your partner along the way.

- Financial Calculators

- Budget (Online or Printable) Forms

- On-Demand Financial Webinars

- Telcoe Arkansas Mobile App

- Christmas, Vacation, Emergency Club Savings Account

- Credit Builder Loan

- Higher Earning Quarter Plus Money Market Account & Certificates of Deposit

- Family Memberships

- Once a Member, Always a Member. We go with you, no matter if you retire or change employment.

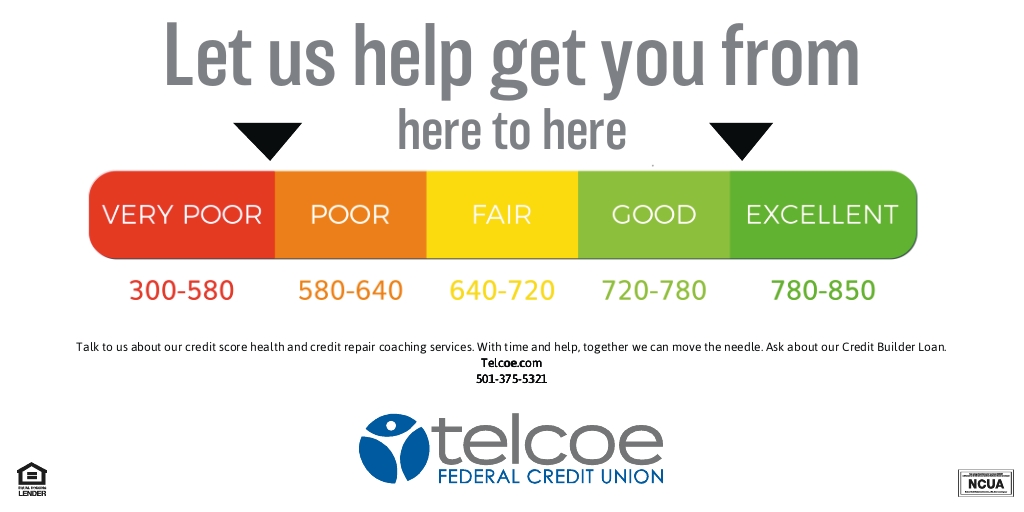

Understanding Your Credit Score

Your financial wellness is important to us, and understanding your credit score helps you improve it. A credit score predicts how likely you are to repay a loan on time, based on information gathered on your credit reports.

There are 3 credit bureaus in the United States. You can obtain a FREE copy of your three bureaus once a year by visiting www.annualcreditreport.com. The bureaus use the information below to derive your credit score. Every lender receives a similar but different credit score and the score a consumer sees on Credit Karma, your credit card statement, etc. will normally be higher than the score a lender receives. This can be confusing to consumers when the scores are not the same.

Your loan approval and the interest rate you receive are based on your credit score. This is known as risk-based pricing. Learn more-HERE

- Bill payment history

- Unpaid debt balances

- Number and type of loan accounts open

- Age of loan accounts open

- Amount of available credit card lines not used

Student Loan Debt

If you are unsure of your next steps, contact GreenPath Financial Wellness to speak with a financial counselor. Telcoe members are able to contact Greenpath till 9 PM or even on Saturday for many types of financial coaching from a compassionate financial expert.

High-Rate Credit Card Debt

The average credit card rate is currently over 20% APR. If you are feeling financial stress and ready to cut up the cards and find a way to pay off the debt at a much lower rate, Telcoe and our partner Greenpath can help. Give us a call to talk through the options that can save you thousands of dollars, and allow you to sleep better.

PATH1

GreenPath Partnership

Telcoe members can contact Greenpath as last as 9 PM or even Saturday to obtain financial coaching, credit report review, etc.

PATH 2

Establish a Credit History

Build the credit history you have always wanted. Telcoe is your financial partner for life.

PATH3

Lower Your Rates

Save money by moving your current loans to Telcoe at a lower rate and repay through payroll deduction. Get a savings quote.

![]()

★★★★★

Tony helped me obtain an Auto loan from Telcoe recently, it was such a refreshingly easy experience!! will recommend Telcoe to anyone for anything! The Human touch is not lost over there!

– Angie W., Little Rock, AR

Financial Wellness FAQs

What is the highest credit score possible?

850 is the highest possible credit score. Achieving a score of 700+ should allow you to receive premium rates and pricing for home/auto insurance, etc. Greenpath offers a webinar on this topic -HERE

I feel overwhelmed, where should I even start?

You are not alone. If you are not actively putting money in a savings account each payday lets start there. We can open a Christmas Club savings account for free. You an start with just $1 per payday if your budget is tight. This small step is monumental in helping prioritize your money priorities. If you would like to talk through all options or meet in person please do reach out at 501-375-5321.

What is the highest-earning account offered by Telcoe Federal Credit Union?

Telcoe offers certificates of deposit with terms of 6 months to 5 years. Visit www.telcoe.com/rates to see the special terms and rates currently being offered. Telcoe also offers a Money market account for savers with at least $2500. This is a great account that allows you to add to it and make withdrawals (3 or fewer per month are FREE). It also pays an above-average dividend.

What vehicles can qualify for a Telcoe FCU auto refinance loan?

You can get auto refinancing for new and used cars or motorcycles that are 2018 or newer with fewer than 80,000 miles. It is worth sending the Vin#, mileage, payoff amount, rate now, payment now, and your estimated credit score to our Loan Professionals for a free savings quote.

How can I establish or rebuild my credit score with Telcoe?

Great question. Give our Telcoe Specialist a call. We can help review your current credit report and then offer you a Credit Builder Loan, a Secured MasterCard, and possibly additional services. Each individual's credit journey is unique so give us a call so we can help you meet your financial goals.

Can I sit down with a human at Telcoe?

Absolutely. Since 1950, we have been meeting our members in person and sitting down and spending time listening to your journey. We look forward to meeting you very soon. You will earn more on your savings, pay less on your loans, and have a financial partner for life with Telcoe.

My financial stress is growing quickly, can Telcoe help?

Yes. We can sit down, review your finances and help you find a plan to meet your financial goals. It can be scary and we have helped many members to overcome financial obstacles. Give us a call today to schedule an appointment. You can also use the budget worksheet to help prepare to meet in person.

Contact Us Today.

Additional Financial Wellness Resources

Read Our Blog for Tips and Tricks

Check Out These Bonus Resources

- Learn about Cash App Scams

- TrueCar Car Buying Service-Discounted Pricing

- GreenPath Financial Management

- Kelley Blue Book Vehicle Values-Get the Most on your Trade